Car Allowance Tax Calculator

Select Cubic capacity of car does. A car allowance calculator for the 2022 tax year that calculates your claim based on the fixed cost method provided by SARS.

Guide To Company Car Tax Cash Allowance And Salary Sacrifice

On the other hand a car allowance means the employer can limit their involvement in finding and maintaining the car.

. Ad Understand why car allowances are taxable and how they can decrease employee productivity. Viewers are advised to ascertain the correct positionprevailing law. I am an Independent Contractor Commission Earner source code 3606 3616.

Theres also taxes to consider as company cars can incur heavier tax. If youre not sure. I receive a Travel Allowance or Taxable Reimbursive Allowance source code 3701 3702 is on my IRP5IT3a.

Monthly value of the use of the car for tax is 3. Cost of car if owned Wear and tear generally 10 Pa. Work-related car expenses calculator This link opens in a new window it will take between 5 and 10 minutes to use this calculator.

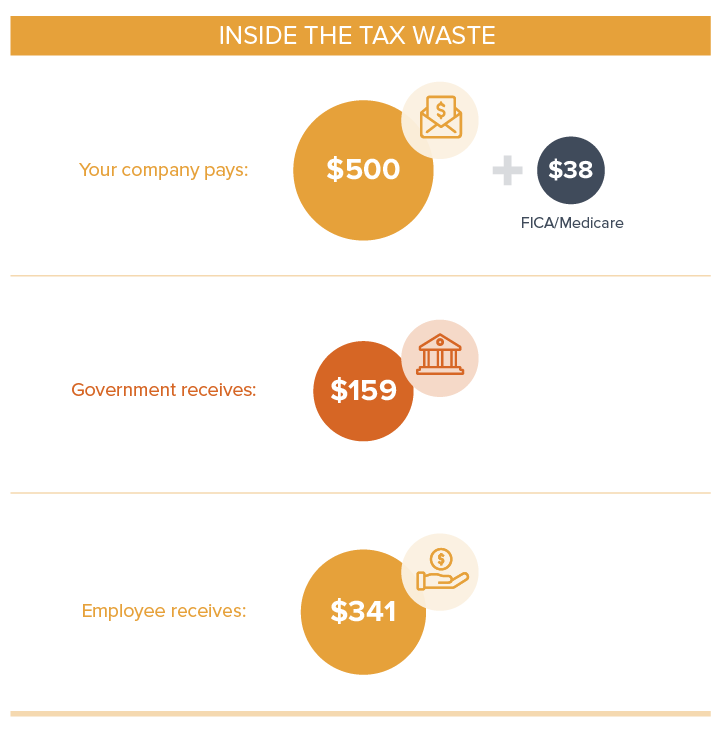

Whatever youre considering youre probably weighing up the pros and cons and trying to figure out how exactly company car tax works and what BIK rates youll fall under or. FAVR was designed as a corporate tax tool to reimburse employees both tax-free and more accurately than a standard car allowance or mileage rate. Discover how you can create an alternative vehicle program thats fair and accurate.

Base their deductions on the expenses they incurred while driving. Information relates to the law prevailing in the year of publication as indicated. Ad Understand why car allowances are taxable and how they can decrease employee productivity.

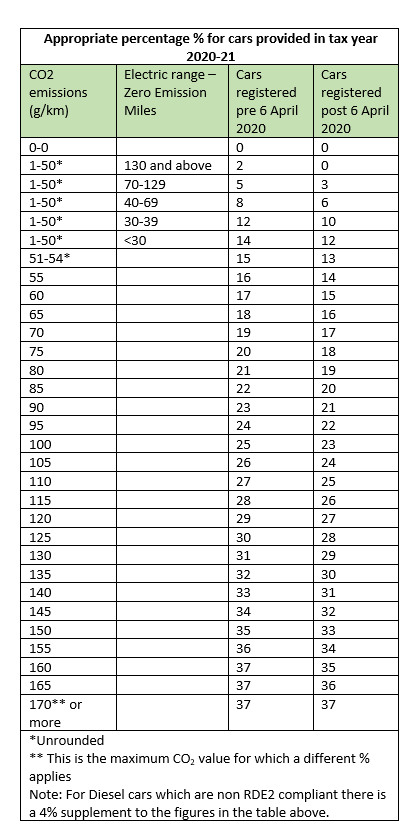

Using the HMRC calculator Choose fuel type F for diesel cars that meet the Euro 6d standard. 28 August 2016 at 1031AM. An allowance paid to an employee is taxable income and tax is required to be.

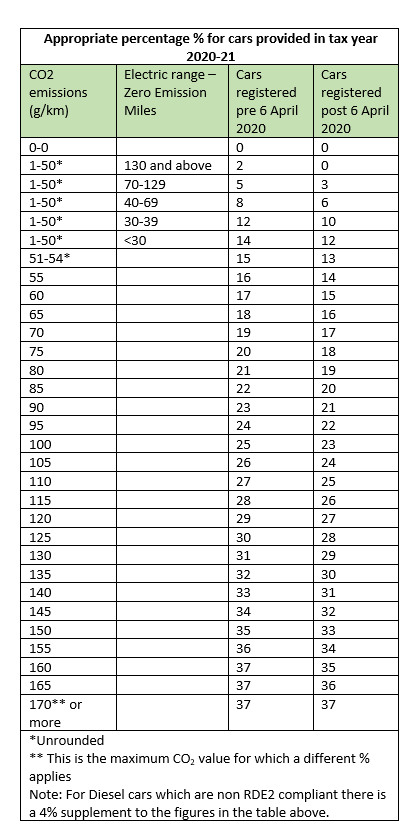

This calculator helps you to. The benefit for an automobile you provide is generally. Employees pay Benefit In Kind BiK on the company vehicle based on the value of the vehicle CO2 emission.

Ad Calculate Your Monthly Car Loan Payments With Tax And See Which Cars Fit Your Budget. The car sales tax in New York is 4 of the purchase price of the vehicle. An operating expense benefit for the year.

The IRS allows employees to calculate their car allowance for mileage reimbursement in the following ways. Company Car Tax Calculator Calculate Company Car Tax. This entry was posted in Tax QA and tagged Salary IRP5 Deductions Commission Travel.

8 hours ago Company Car Tax Calculator This free calculator is a device or tool that helps to calculate the amount of tax you. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees. Unlike other approaches a FAVR car.

Calculating automobile benefits. When buying a car in New York you will pay a 4 sales tax rate for your new vehicle according to Sales Tax States. Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary.

Discover how you can create an alternative vehicle program thats fair and accurate. Know Your Payment Options While You Shop With No Hit To Your Credit Score. Payment of a car allowance gives rise to a number of tax questions.

Hire charges if hired Salary of driver if provided Running and maintenance by employer. A standby charge for the year. 5 of VAT inclusive cost of the car.

YourTax Tax calculator Compare yearly tax. Once youve worked out what you can claim you can claim it via a tax return. This statewide tax does not include any county or city.

Or you can use HMRCs company car and car fuel benefit calculator if it works in your browser. The Mileage Allowance is a tax-free allowance that you can claim if you use your car for business. For instance if you pay 40000 for a new vehicle the state sales tax will be 1600.

Automobile Benefits Online Calculator - Disclaimer.

A Guide To Company Car Tax For Electric Cars Clm

Car Allowance Vs Company Car Which Is Right For Your Business

How Is The Company Car Allowance Cash Option Calculated Lease Fetcher

Allowance Vs Cent Per Mile Reimbursement Which Is Better

2022 Everything You Need To Know About Car Allowances

Helpful Resources For Calculating Canadian Employee Taxable Benefits The Art Of Accounting Burlington

Car Allowance Tax Cash Allowance Revisions 2020 Fleet Alliance

Tasc Car Deloitte Company Car Calculator Deloitte Belgium Tax

2022 Everything You Need To Know About Car Allowances

How To Get A Tax Benefit For Buying A New Car Axis Bank

Company Car Or Car Allowance Which Is Better For You

What You Need To Know When Claiming A Car Allowance Fiscal Private Client Services

Car Benefits Data Input Calculation 2020 21 Moneysoft

Company Cash Allowance Vs Company Car Vanarama

Tasc Car Deloitte Company Car Calculator Deloitte Belgium Tax

Should You Take A Company Car Or A Car Allowance

Comments

Post a Comment